Digitalexpense tracking in Odoo: Save time and money

Digital expense tracking in Odoo: Save time and money

Managing business expenses can be tedious, paper receipts, Excel sheets, manual approvals. But it doesn’t have to be. With Odoo’s digital expense tracking, Belgian SMEs can simplify the process, cut administrative time, and gain real-time visibility into company spending.

In this tutorial, we’ll show you how to manage expenses in Odoo, from receipt upload to reimbursement, fast, accurate, and fully digital.

Why automate expense tracking?

Most businesses still rely on outdated methods to handle expense claims:

- Paper receipts are lost or damaged

- Manual approval workflows cause delays

- Employees wait weeks for reimbursement

- Admins spend hours copying data into spreadsheets

The result? Wasted time, unhappy employees, and financial blind spots.

Digital expense tracking solves this by:

- Automating submissions and approvals

- Centralizing all data in one system

- Ensuring compliance with tax authorities

- Reducing human error and fraud risk

How Odoo simplifies expense management

Odoo’s Expense module is designed to be simple, mobile-friendly, and fully integrated with your accounting system.

Submit expenses in seconds

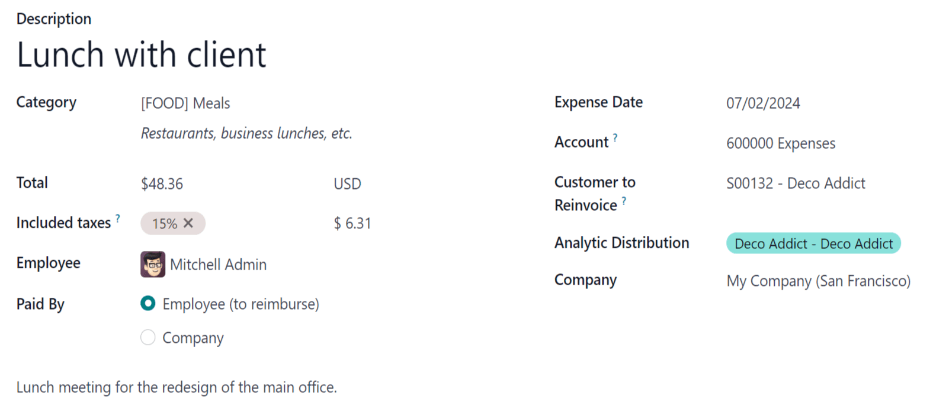

Employees can:

- Snap a photo of a receipt on their phone

- Upload it via the Odoo mobile app or web browser

- Add details (category, amount, project, notes)

- Submit with one click

Each expense is automatically:

- Categorized

- Linked to the right journal

- Forwarded to the manager for approval

Approval workflows made easy

Managers receive instant notifications when an expense is submitted. They can:

- Review details and the attached receipt

- Approve or reject directly in Odoo

- Add comments or request corrections

You can configure:

- Multi-level approval (e.g. team lead → finance)

- Expense limits per employee or category

- Email or app notifications

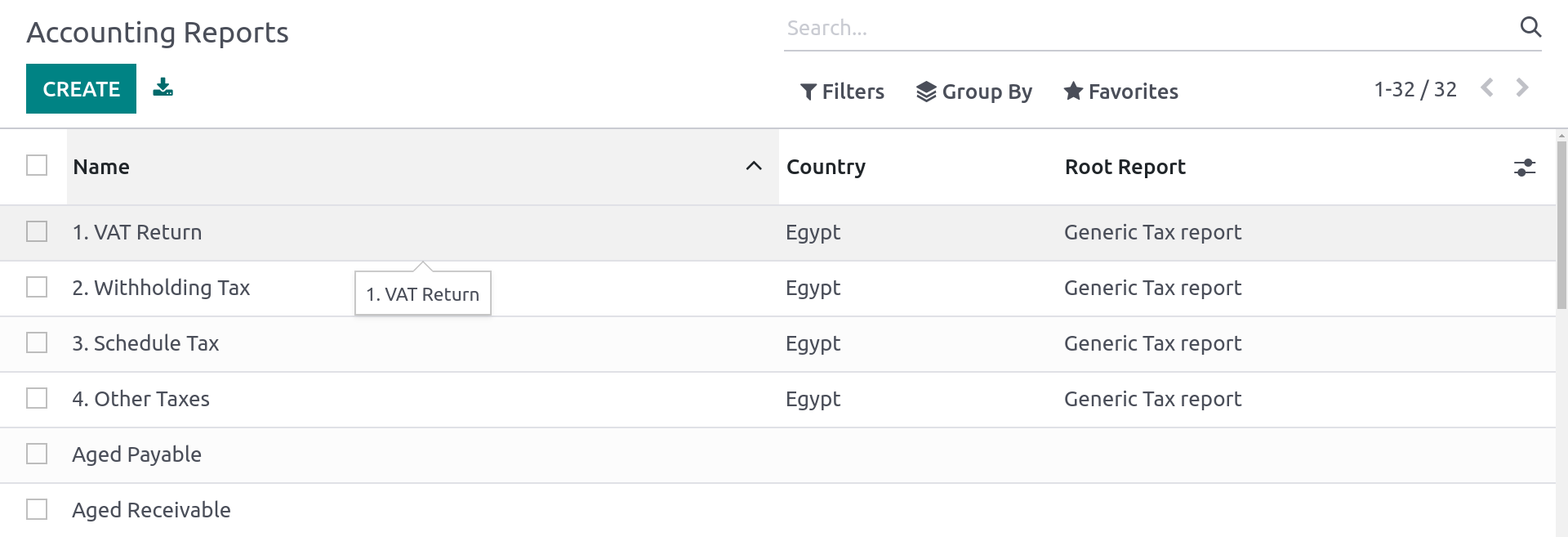

Seamless accounting integration

- Expenses are automatically posted to the correct accounts

- VAT is extracted if applicable

- Reports and journals are updated in real time

- Reimbursements can be tracked through payroll or supplier payments

Real-world examples: from receipts to reimbursements

Let’s look at how Belgian SMEs can use Odoo for common expenses:

No more shoe boxes of receipts—just instant digitization and control.

Key benefits for Belgian SMEs

- Fast expense submissions via mobile

- Automatic VAT detection for BE compliance

- Paperless workflows for faster approvals

- Real-time reporting on employee spend

- Linked to accounting and payroll

- Supports Peppol / digital invoicing rules

Plus, all your expense data is safely stored, searchable, and audit-ready.

Automate and scale with Bodoo

At Bodoo, we help Belgian SMEs take their Odoo expense management to the next level.

We assist with:

- Configuring custom approval flows

- Mapping expense categories to your COA

- Setting up integrations with payroll or external tools

- Localizing settings for Belgian tax and VAT rules

Whether you're tracking mileage, travel, or team lunches, we’ll help you save hours every month—and stay compliant.