Belgian VAT return in Odoo: step-by-step guide

Belgian VAT return in Odoo: step-by-step guide

Submitting your Belgian VAT return doesn't have to be complicated, especially when you're using Odoo Accounting. Whether you're a growing SME or an established enterprise, this guide will walk you through the entire process of preparing and filing your Belgian VAT declaration directly from Odoo. Say goodbye to manual spreadsheets and hello to automated compliance.

Why is Belgian VAT compliance crucial?

Belgium has one of the most complex VAT systems in Europe, with frequent updates to tax rates, exemptions, and reporting obligations. For Belgian companies, staying compliant is not just a legal obligation, it’s a financial necessity. Mistakes in VAT reporting can lead to fines, audits, and cash flow issues.

Luckily, Odoo’s accounting module is fully equipped to handle the nuances of Belgian VAT rules, as long as it's correctly configured.

Setting up VAT in Odoo for Belgian rules

Before you can submit your VAT return, you need to make sure your Odoo environment is properly set up for Belgian compliance.

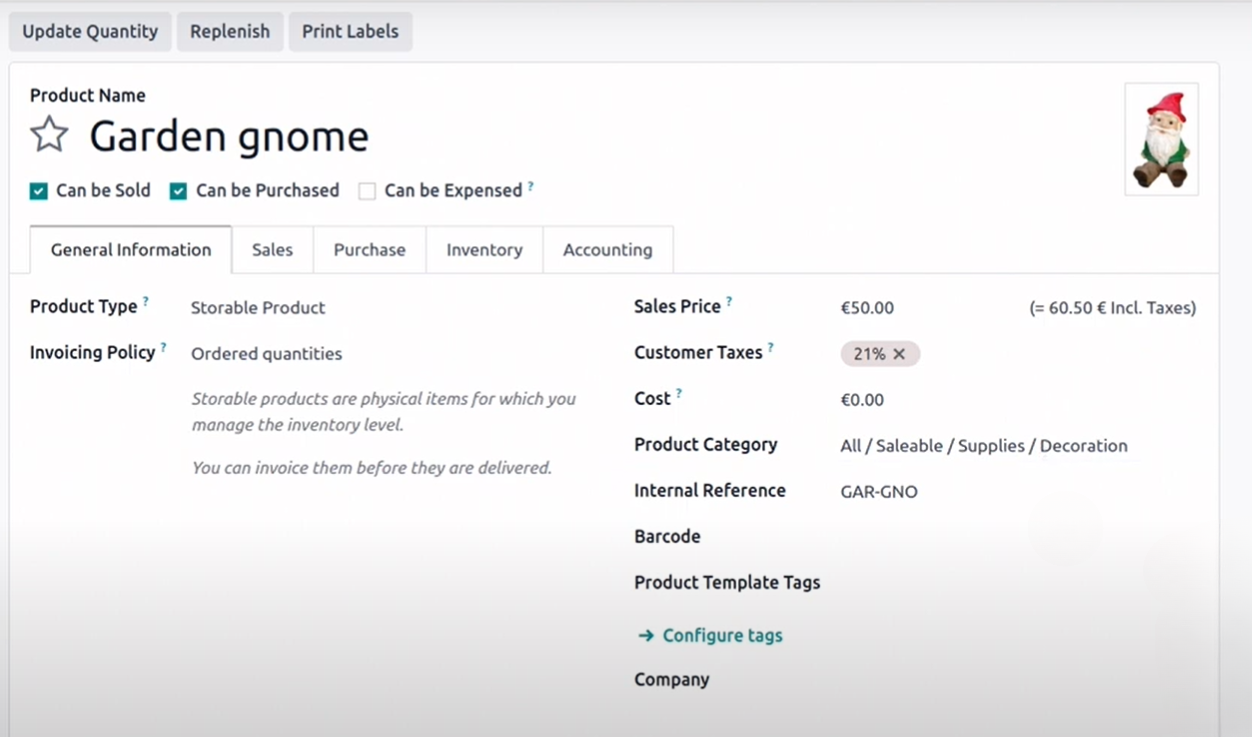

1. Configure VAT rates

Belgium uses multiple VAT rates:

- 21% standard rate

- 12% reduced rate

- 6% super reduced rate

- 0% and exemptions

In Odoo:

- Go to Accounting > Configuration > Taxes

- Create or verify the relevant tax codes (e.g., BE21, BE12, etc.)

- Make sure each tax is assigned to the correct Tax Group and Country

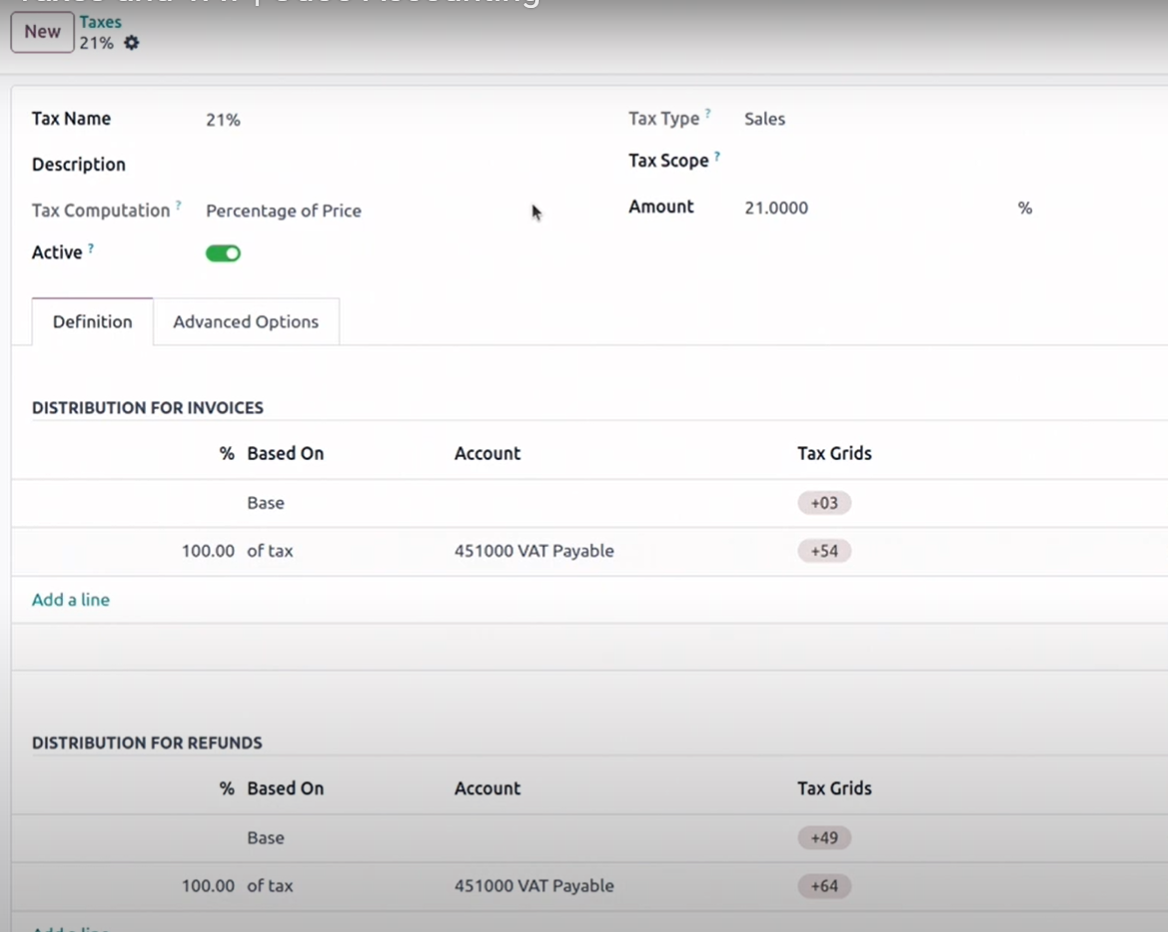

2. Link taxes to accounts and journals

Every tax must be linked to:

- A Sales Tax Account

- A Purchase Tax Account

- The correct Journals (e.g., Sales, Purchases)

This ensures that every transaction is reported correctly and reflected in your VAT statement.

Generate and review your VAT report

Once your accounting is up to date and reconciled, follow these steps:

- 1. Go to Accounting > Reporting > Tax Report

- 2. Select the Belgian Localization format

- 3. Choose the correct Period (monthly or quarterly, based on your VAT regime)

- 4. Click Generate to see a preview

The report will display:

- VAT collected on sales

- VAT paid on purchases

- Net amount due or to be refunded

Tip: Always double-check the totals, especially after major invoice corrections or journal imports.

Submit your Belgian VAT return

Belgian companies must submit their VAT returns electronically via Intervat or Peppol. Odoo allows you to:

1. Export the XML file

In the tax report view, click Export > Belgian VAT XML

2. Upload to Intervat

Visit https://eservices.minfin.fgov.beLog in with your eID or CSAM account

3. Validate and submit

Follow the steps on the portal to upload and confirm your declaration

If you're registered for monthly VAT prepayments or OSS (One Stop Shop), make sure to handle those separately.

Commonissues and how to fix them

Don't panic, most problems are caused by missing configurations and are easily fixed once identified.

Automate VAT tasks with Bodoo

Tired of handling VAT manually every quarter?

At Bodoo, we help Belgian companies automate VAT flows, detect inconsistencies early, and ensure clean submissions, on time, every time.

We also help with:

- Odoo VAT setup and localization

- Audit-proof tax mapping

- Peppol and Intervat integrations

- Digital invoicing compliance

Want to avoid penalties and save time? Let’s make your VAT 100% automated.