Budgeting in Odoo: From planning to reporting

Budgeting in Odoo: From planning to reporting

A good budget is more than just numbers on a spreadsheet—it’s a powerful tool for smarter decision-making. With Odoo’s budgeting features, Belgian SMEs can plan ahead, track actual performance, and adjust their strategy in real time.

In this guide, we’ll show you how to create and manage budgets in Odoo, compare them with actuals, and gain financial control over your operations.

Why budgeting matters for Belgian SMEs

Without a structured budget, it’s easy to:

- Overspend without noticing

- Miss financial goals

- React too late to unexpected costs

With a clear, data-driven budget in Odoo, you can:

- Align teams around financial targets

- Track real-time variances

- Make faster, more confident decisions

- Stay compliant with tax and subsidy reporting

Whether you're managing a marketing campaign, team expenses, or operational costs, Odoo helps you translate goals into numbers, and numbers into insight.

Setting up your first budget in Odoo

Budgeting in Odoo is fully integrated with your accounting, so there’s no need for duplicate data or manual syncing.

Define budgetary positions

A budgetary position links your budget to the right general ledger accounts (GL accounts). For example:

- Office supplies → account 610000

- Marketing expenses → account 620000

- Salaries → account 700000

This ensures that your actual expenses can be compared directly to your budgeted figures.

Create a new budget

Go to: Accounting > Management > Budgets > Create

Define:

- Budget name (e.g., Q3 2025 Marketing Budget)

- Period (start and end date)

- Responsible person (budget owner)

- Company (if you manage multiple)

Assign budget lines and responsible users

Each budget line includes:

- A budgetary position

- Planned amount

- Date range

- Responsible user or team

For example:

Budget line for Google Ads, July–September: €4,500

Linked to Marketing GL account

Odoo then compares this line against the actual booked expenses from the linked accounts.

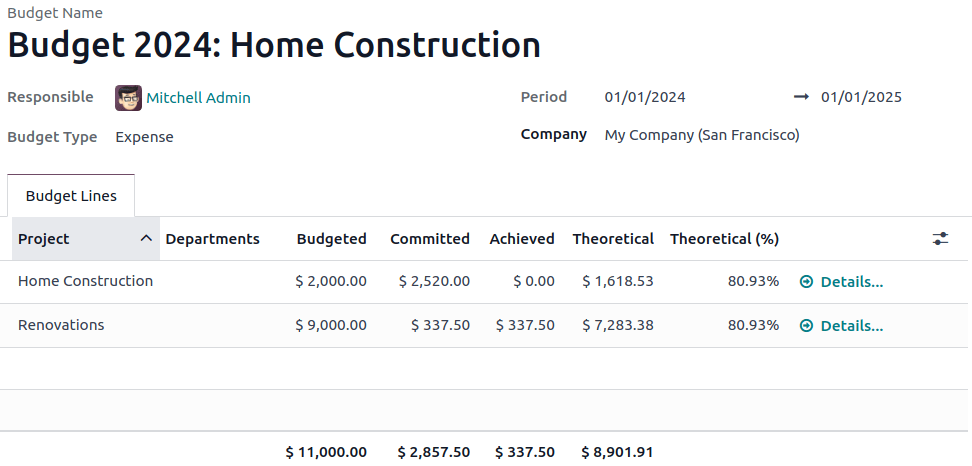

Monitor performance: budget vs actual

Once your budget is active, you can start monitoring performance immediately.

Real-time dashboards and reporting

Navigate to: Accounting > Reporting > Budgets

There you’ll see:

- Budgeted vs actual amounts

- Percentage of consumption

- Remaining budget per position

- Drill-down by team, department, or project

Alerts and budget control

Odoo also allows you to:

- Trigger alerts when a threshold is reached

- Prevent overspending with approval rules

- Export reports for board meetings or stakeholders

This makes your budget a living tool, not just a static plan.

Practical examples: marketing, HR, operations

Here’s how real Belgian SMEs use Odoo’s budgeting features:

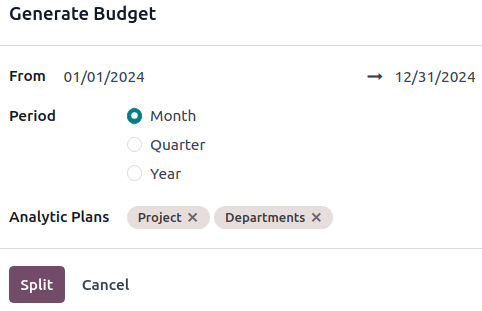

Budgets can also be linked to analytic accounts or projects, offering granular visibility.

Go further with Bodoo’s budgeting expertise

At Bodoo, we help companies:

- Set up custom budget structures

- Align cost centers and analytic tags

- Automate reporting flows

- Train teams on budget ownership

Our clients use Odoo not just to track costs, but to drive strategic planning. From basic cost monitoring to advanced forecasting, we tailor the budgeting module to your needs.