How to choose the right accounting software for your Belgian SME

How to choose the right accounting software for your Belgian SME

Choosing accounting software can feel overwhelming—especially with so many options on the Belgian market. Whether you're a startup or a growing SME, finding the right tool is essential for saving time, staying compliant with Belgian regulations, and making better business decisions.

In this guide, we’ll walk you through the key criteria to consider, compare popular platforms like Yuki, Exact, Odoo, and Octopus, and help you make an informed choice for your company.

Why Belgian SMEs need the right accounting software

Belgian companies face unique accounting challenges, including:

- Strict VAT reporting obligations (monthly or quarterly)

- Intervat submission requirements

- Digital invoicing rules (e.g., Peppol)

- Complex Belgian payroll and chart of accounts setups

The right software ensures:

- Compliance with Belgian laws and tax rules

- Efficiency in invoicing, expense tracking, and reporting

- Scalability as your company grows

Key criteria when choosing accounting software in Belgium

When evaluating accounting tools, keep these four areas in mind:

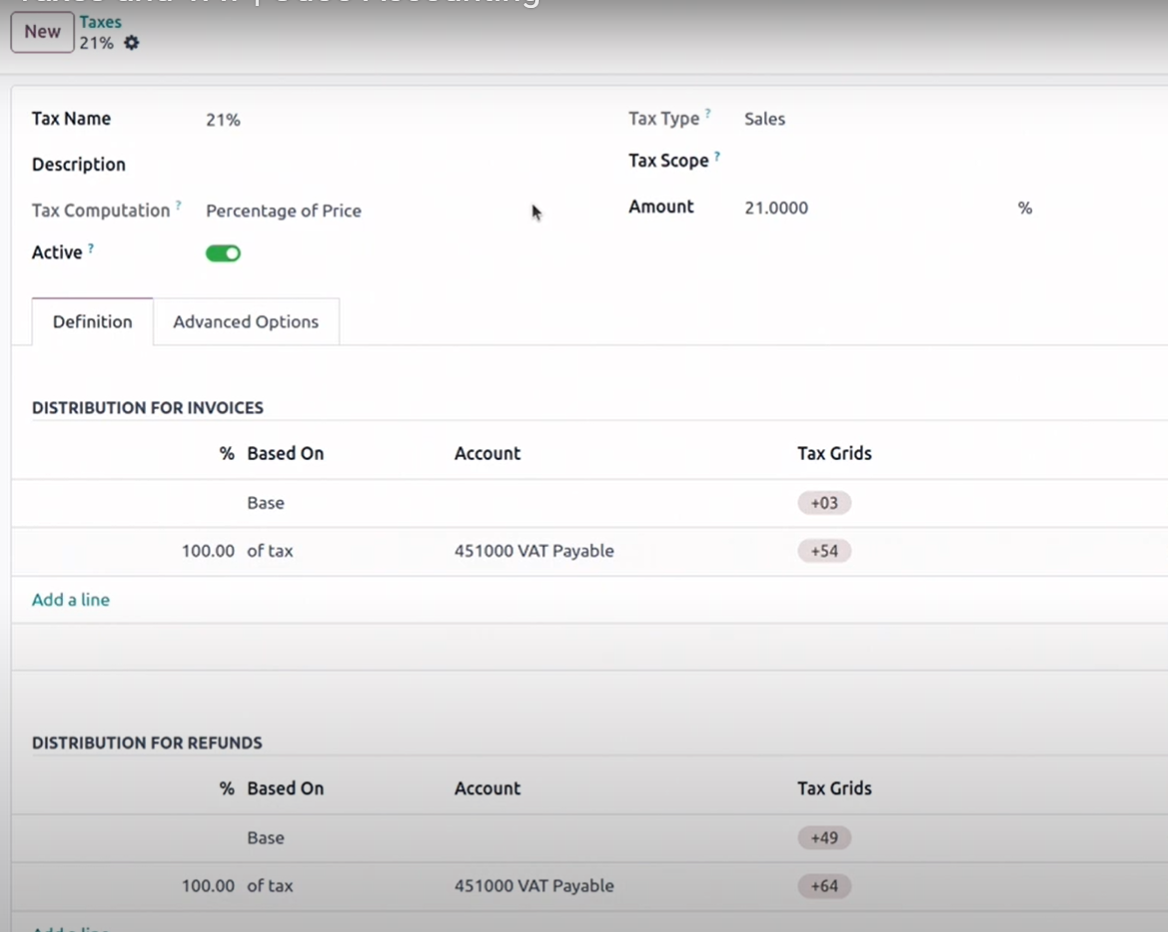

1. Belgian VAT and compliance support

Your software must support:

- Automatic VAT calculations (standard, reduced, exempt)

- BE tax reports in XML format

- Intervat and Peppol integrations

- Correct Belgian COA (chart of accounts) structure

2. Automation and integrations

Time-saving features are key:

- Automatic bank sync (e.g., via CodaBox)

- Smart invoice matching and OCR scanning

- Integration with CRM, HR, e-commerce, or project management tools

3. Pricing and scalability

- Does the pricing match your current needs and future growth?

- Are modules like inventory, payroll or HR included or extra?

- Can you start small and upgrade later?

4. Ease of use and support

- Is the user interface beginner-friendly?

- Is documentation available in Dutch, French, or English?

- Does the vendor offer local support or partners in Belgium?

Comparison: Yuki vs Exact vs Odoo vs Octopus

Here’s a high-level comparison of four major accounting solutions used by Belgian SMEs:

Pros and Cons

•OCR and automation built-in

•No Intervat export

•Established in Belgium

•Can be complex to implement

•Strong compliance for BE (VAT, Intervat, Peppol)

•Integrates natively with sales, CRM, inventory, etc.

•Good for sole traders or freelancers

•Limited integrations

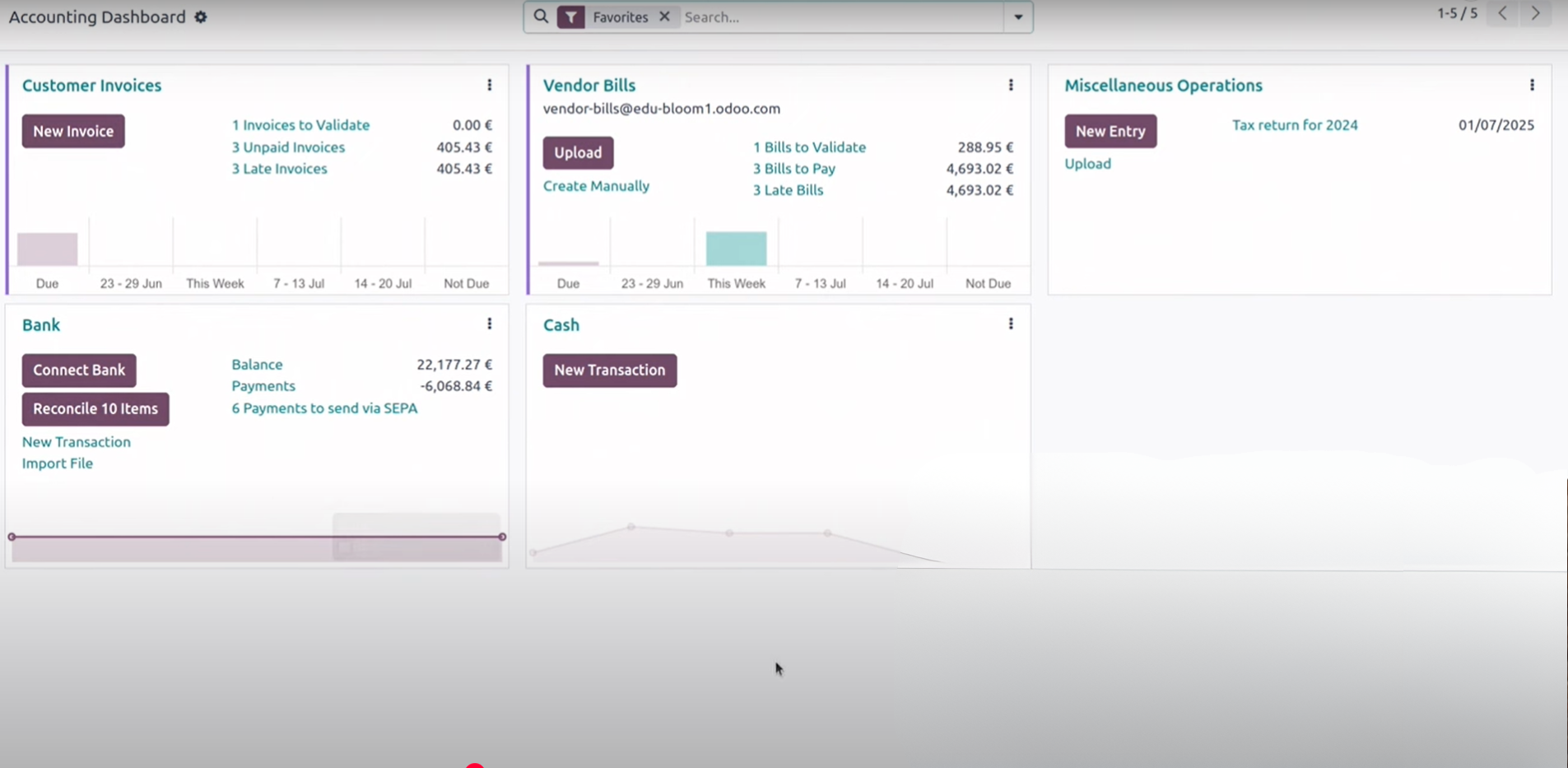

Bodoo’s take: Why we recommend Odoo for most SMEs

At Bodoo, we’ve worked with dozens of Belgian SMEs across sectors like logistics, retail, and consulting. In most cases, Odoo offers the best balance between:

- Belgian compliance

- Scalability and modularity

- Cost-efficiency

- Integration possibilities

With the right partner, Odoo transforms from a basic accounting tool into a complete business platform tailored to your needs. We handle the technical setup, compliance rules, and user training—so you can focus on your business.

Want a personalized recommendation?